Up to $500 in 5 min or less¹

Download the app designed to make finances easier—from taking ExtraCash® to saving for your Goal.

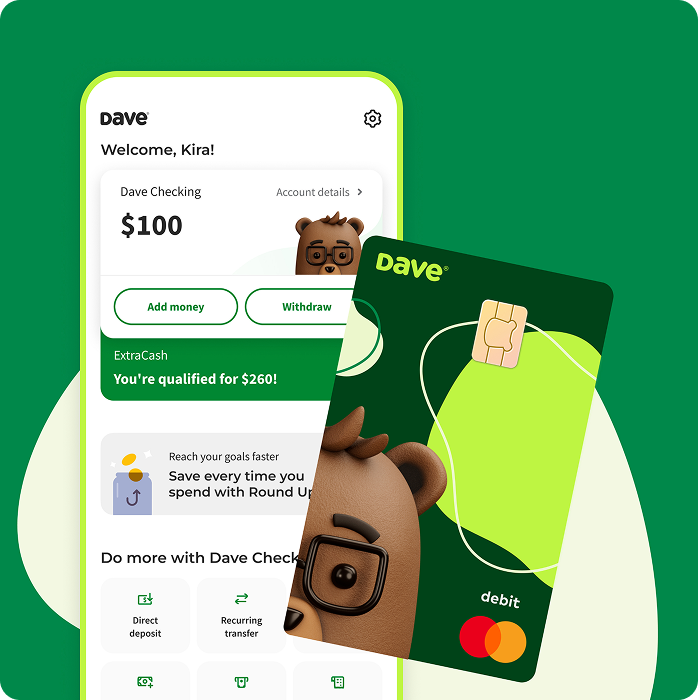

Get cash instantly with Dave Checking¹

You could get ExtraCash after you download Dave, connect a bank account, open an ExtraCash account, and transfer it to a Dave Checking account. Settle it later with no interest or late fees.

We’ve helped 6M+ members get ExtraCash

Dave Checking account

Spend on your terms with Dave Checking

Control how you spend, budget, and deposit money with the Dave Checking account. You can also get your paycheck up to 2 days early with direct deposit2 and Round Up your purchases for savings.

Goals account

Own your savings journey

Create personalized savings Goals, fund them automatically with Round Ups, and track your progress every dollar of the way. There’s no minimum deposit or commitment.

Catch us in the press

Security and fraud prevention

Every account is FDIC-insured up to $250K through Evolve Bank & Trust, Member FDIC, or another partner bank. Conditions apply.4