Making finances easier

Dave is a financial app on a mission to build products that level the financial playing field.

Fighting for the underdog

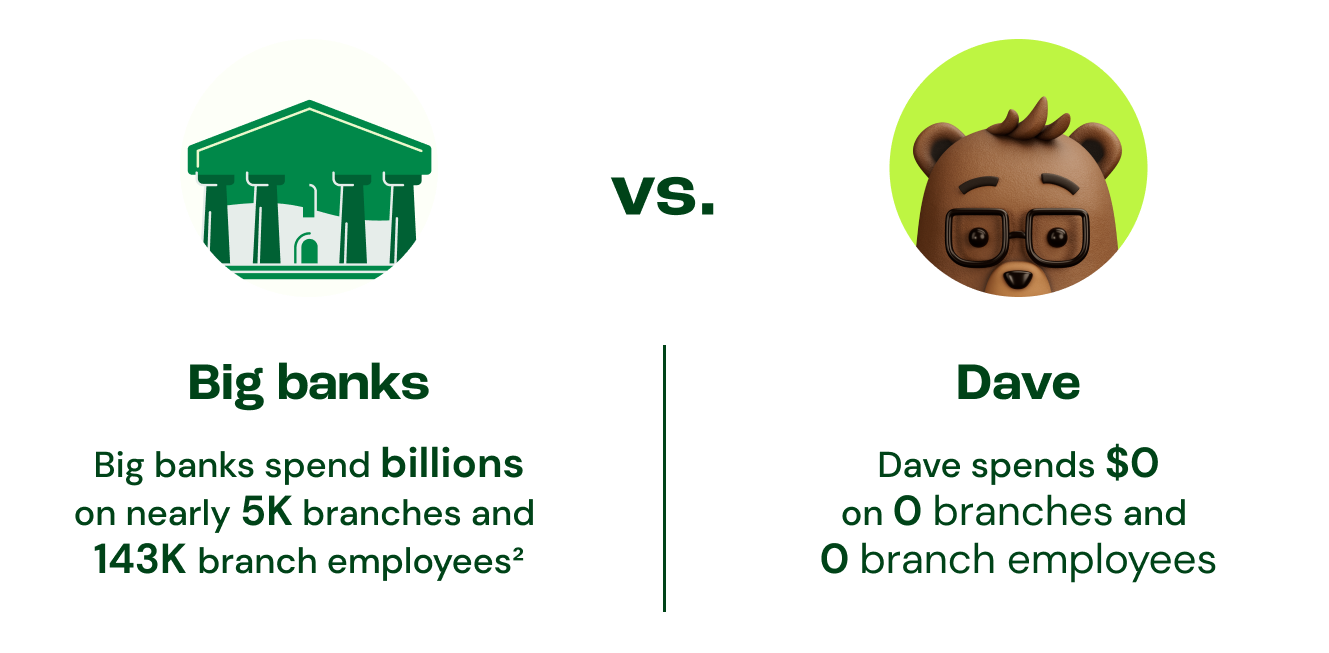

We started Dave for one reason: banking hadn’t changed in decades1, and we knew we deserved better. Like David slaying Goliath, we set out to challenge the old ways of managing money and make financial security more accessible to all.

Branch costs for

Features that work for you

Because we keep our operating costs low, we give our 13.5M members features that work as hard as they do. That starts with getting them ExtraCash® up to $500—with no credit check—when they're behind on their budget.3

Introducing CashAI™

CashAI™ is our proprietary AI underwriting model that analyzes cash flow, not credit scores, to determine our members’ ExtraCash® eligibility every time they need more money. Highly dynamic and personalized, CashAI™ looks at 180+ different data points, including members’ income, irregular employment, bank balance, spending patterns, and history with Dave.

Helping members with DaveGPT

DaveGPT, our generative AI assistant, provides real-time support to members right through the app. More conversational than a chatbot, DaveGPT can answer questions, set up direct deposits, manage ExtraCash® accounts, and more—with an 82% resolution rate.

Our values

They serve as a compass guiding who we are, how we work, and what we’re focused on next.

Member Centric

We care deeply about our members.

Helpful

Being helpful is part of our DNA.

Transparent

We are open, honest, and straightforward.

Persistent

We don't give up when things get challenging.

Better together

Opportunity exists for everyone at Dave.

Join the team

Help make a difference in improving our members’ relationship with money and join our growing team.