Your ultimate financial friend

Manage your money with products designed to make finances easier.

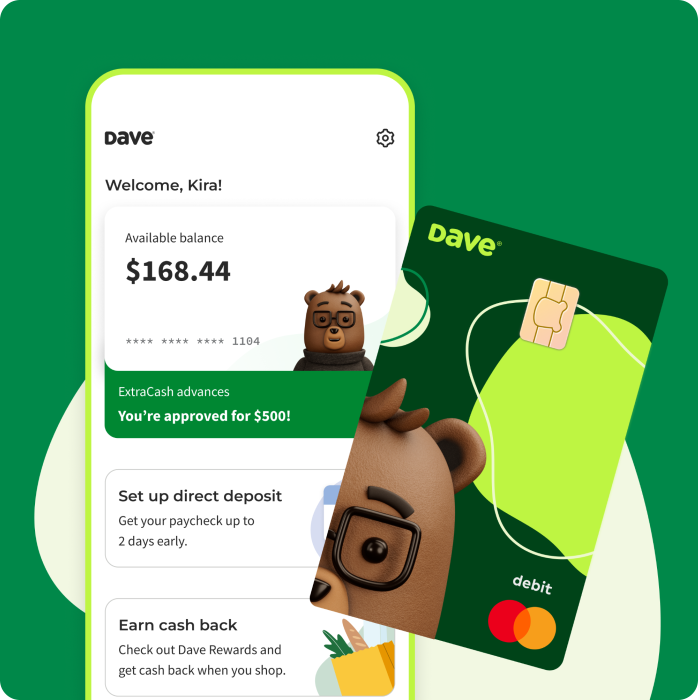

ExtraCash™ account

Get up to $500 in 5 minutes or less¹

You could get an ExtraCash™ advance as soon as you download Dave, connect a bank account, and transfer it to a Dave Spending account. Settle it later with no interest or late fees.

We’ve helped 6M+ members take 97M+ advances ²

Dave Spending account

Spend on your terms with Dave Spending

Control how you spend, budget, and deposit money with the Dave Spending account. You can also earn up to 15% cash back on select offers when you use the Dave Debit Mastercard®3, Round Up your purchases for savings, and earn interest.

NEW

Goals account

Save more with 4.00% APY⁴

Own your savings journey with the Goals account. Add money at your pace and earn interest along the way with our high annual percentage yield (APY).

Side Hustle

Find 1K+ ways to earn

If you’re short on cash, you’ve got options. Take Surveys that pay out instantly to your Dave Spending account. Or apply for jobs hassle-free through our Side Hustle board.

Catch us in the press

No hidden fees

You work too hard to spend your money on overdraft fees and minimum balance fees.

Security and fraud prevention

Every account is FDIC-insured up to $250K through our partner bank, Evolve Bank & Trust, Member FDIC.